Case Based Questions: Consideration | Business Laws for CA Foundation PDF Download

CA Foundation - Indian Regulatory Framework: New Consideration and Taxation Conflicts Case-Based Questions (Subjective)

Case Study 1: The Startup Barter Deal

Arjun, a startup owner, agrees to provide marketing services to Nisha’s e-commerce platform in exchange for ₹3 lakhs worth of products as consideration. The GST authorities demand 18% GST on the barter, which Arjun disputes, claiming it’s non-taxable.

Question: Discuss the validity of in-kind consideration under the Indian Contract Act, 1872, and whether the barter attracts GST under the CGST Act, 2017, resolving the taxation conflict within the Indian Regulatory Framework.

Answer: Under Section 2(d) of the Indian Contract Act, 1872, consideration can include in-kind payments, such as products, if lawful and at the promisee’s desire. Arjun’s agreement to provide marketing services for Nisha’s ₹3 lakh products constitutes valid consideration, forming a contract, as seen in Chinnaya v. Ramayya (1882), where non-monetary consideration was upheld if mutually agreed. Under Section 7 of the CGST Act, 2017, barter transactions are taxable supplies, with GST (18% for services/products) calculated on the market value of goods under Section 15. The GST authorities’ demand is valid, as confirmed in Mohit Minerals Pvt. Ltd. v. Union of India (2020), where the Gujarat High Court upheld GST on barter transactions. The Indian Regulatory Framework requires Arjun to issue a GST-compliant invoice and pay tax, allowing Nisha to claim input tax credit (ITC) under Section 16. Non-compliance risks penalties under Section 122. Arjun’s CA should advise registering the barter and ensuring tax payment, aligning the valid contract with GST obligations to resolve the dispute.

Case Study 2: The Freelancer’s TDS Dispute

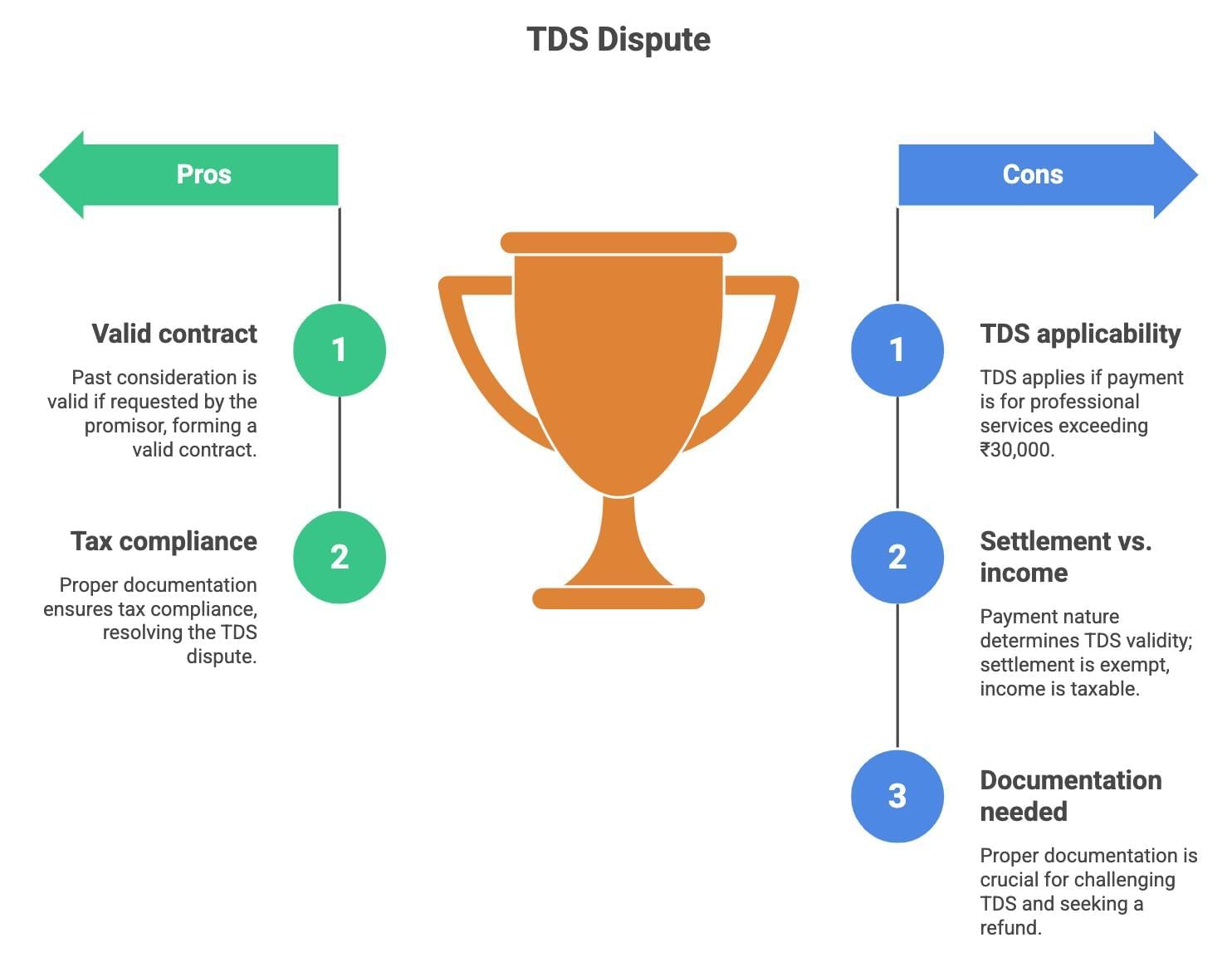

Sneha, a freelance designer, receives ₹2 lakhs from Rohan’s company as consideration for past design work. Rohan deducts 10% TDS under Section 194J, but Sneha argues the payment is a settlement, not professional income, refusing TDS.

Question: Evaluate the validity of past consideration under the Indian Contract Act, 1872, and the TDS applicability under the Income Tax Act, 1961, resolving the taxation conflict.

Answer: Under Section 2(d) of the Indian Contract Act, 1872, past consideration is valid if provided at the promisor’s request. Sneha’s past design work, if requested by Rohan, forms a valid contract, as upheld in Lampleigh v. Brathwait (1615), a principle applied in Indian law in Sindha Shri Ganpatsinghji v. Abraham (1895), recognizing past services as consideration. Under Section 194J of the Income Tax Act, 1961, TDS at 10% applies to professional fees exceeding ₹30,000. If the ₹2 lakh payment is for professional services, TDS is valid; if it’s a settlement for a dispute, it’s a capital receipt, exempt from TDS, as clarified in CIT v. Saurashtra Cement Ltd. (2010). The Indian Regulatory Framework resolves this by requiring Rohan to document the payment’s nature. Sneha can challenge the TDS with evidence of a settlement, seeking a refund via Form 26AS. The CA should advise proper documentation, ensuring the contract’s validity aligns with tax compliance to resolve the dispute.

Case Study 3: The Charity Donation Conflict

Vikram agrees to donate ₹5 lakhs to Meera’s NGO as consideration for her organizing a business event. The Income Tax Department demands tax from Meera, claiming the donation is taxable income, which she disputes.

Question: Analyze the donation as consideration under the Indian Contract Act, 1872, and its taxability under the Income Tax Act, 1961, resolving the taxation conflict within the Indian Regulatory Framework.

Answer: Under Section 2(d) of the Indian Contract Act, 1872, a donation can be valid consideration if made at the promisee’s desire. Vikram’s ₹5 lakh donation for Meera’s event services forms a valid contract, as supported by Chinnaya v. Ramayya (1882), where payment for services was valid consideration. Under Section 12AA of the Income Tax Act, 1961, donations to registered NGOs are exempt if used for charitable purposes, as clarified in CIT v. Shri Ram Memorial Foundation (2004), where the Delhi High Court upheld tax exemptions for registered NGOs. If Meera’s NGO is unregistered, the ₹5 lakh is taxable as business income under Section 28. The Indian Regulatory Framework requires Meera to provide proof of NGO registration and fund usage. Vikram’s CA should advise issuing a donation receipt and maintaining records. If taxable, Meera must report the income. Proper documentation aligns the contract’s validity with tax compliance, resolving the dispute.

Case Study 4: The Event Planner’s GST Issue

Riya, an event planner, agrees to organize a corporate event for Sameer’s firm, receiving ₹4 lakhs in advance as consideration. The GST authorities demand 18% GST on the advance, which Riya disputes, claiming it’s not yet earned.

Question: Discuss the advance payment as consideration under the Indian Contract Act, 1872, and GST liability under the CGST Act, 2017, resolving the taxation conflict.

Answer: Under Section 2(d) of the Indian Contract Act, 1872, advance payment is valid consideration, forming a contract, as seen in Durga Prasad v. Baldeo (1880), where consideration supported a binding agreement. Riya’s ₹4 lakh advance from Sameer is lawful consideration. Under Section 13 of the CGST Act, 2017, GST is payable on advances for services (18% for event planning) at the time of receipt, as upheld in Kushal Infraproject Industries (India) Ltd. v. Union of India (2019), where advance payments were taxable. The GST authorities’ demand is valid, creating a taxation conflict. The Indian Regulatory Framework requires Riya to issue a GST-compliant advance receipt and pay tax, with Sameer claiming ITC under Section 16. Non-compliance risks penalties under Section 122. Riya’s CA should advise registering the advance and adjusting tax upon service completion, ensuring the contract’s validity aligns with GST compliance to resolve the dispute.

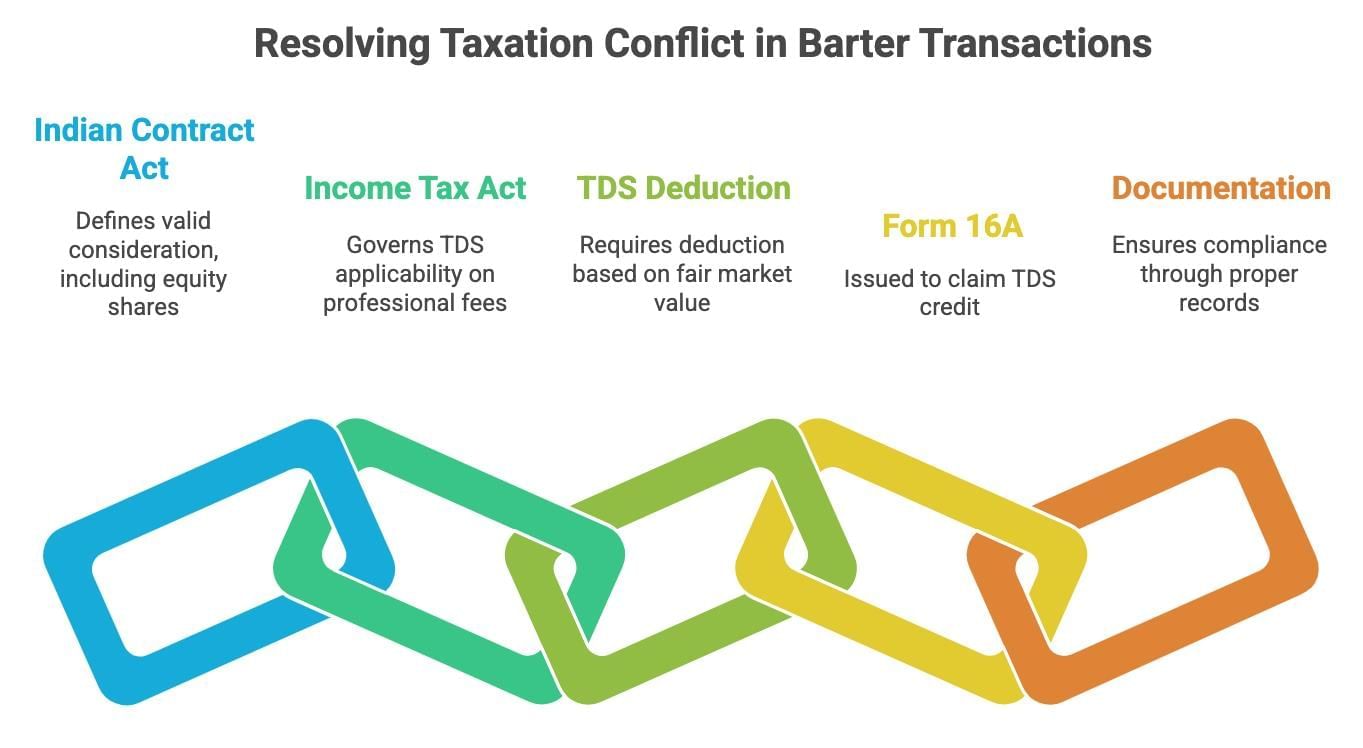

Case Study 5: The Consultancy Barter and TDS

Karan, a consultant, provides services to Anjali’s startup in exchange for ₹2 lakhs in equity shares as consideration. Anjali deducts 10% TDS, claiming it’s a professional fee, but Karan disputes this, arguing it’s a barter transaction.

Question: Evaluate the equity shares as consideration under the Indian Contract Act, 1872, and TDS applicability under the Income Tax Act, 1961, resolving the taxation conflict.

Answer: Under Section 2(d) of the Indian Contract Act, 1872, non-monetary consideration like equity shares is valid if lawful and agreed upon. Karan’s shares form a valid contract with Anjali, as supported by Chinnaya v. Ramayya (1882), where non-cash consideration was upheld. Under Section 194J of the Income Tax Act, 1961, TDS at 10% applies to professional fees, and barter transactions are valued at market rates for tax purposes, as clarified in CIT v. Hindustan Lever Ltd. (2014), where non-monetary payments were taxable. The ₹2 lakh equity payment attracts TDS if classified as professional services. The Indian Regulatory Framework requires Anjali to deduct TDS on the shares’ fair market value and issue Form 16A. Karan can claim TDS credit. The CA should advise documenting the barter agreement and valuation, ensuring the contract’s validity and tax compliance to resolve the dispute.

Case Study 6: The Property Deal’s Stamp Duty

Pooja agrees to pay ₹1 lakh stamp duty on behalf of Aryan’s firm as consideration for a property lease contract. The GST authorities demand 18% GST on this payment, which Pooja disputes, claiming it’s a tax, not a service.

Question: Analyze the stamp duty payment as consideration under the Indian Contract Act, 1872, and GST liability under the CGST Act, 2017, resolving the taxation conflict.

Answer: Under Section 2(d) of the Indian Contract Act, 1872, paying stamp duty is valid consideration if done at the promisor’s desire. Pooja’s ₹1 lakh payment forms a valid contract with Aryan, as seen in Chinnaya v. Ramayya (1882), where payment for another’s benefit was valid consideration. Under Section 7 of the CGST Act, 2017, GST applies to supplies, but stamp duty under the Indian Stamp Act, 1899, is a tax, not a taxable service, as clarified in Intercontinental Consultants and Technocrats Pvt. Ltd. v. Union of India (2013), where the Delhi High Court exempted statutory payments from service tax (pre-GST). The GST authorities’ demand is invalid. The Indian Regulatory Framework resolves this by exempting stamp duty from GST. Pooja’s CA should advise challenging the demand via a writ petition under Article 226, proving the payment’s tax nature. The contract remains enforceable, and proper documentation ensures compliance, resolving the dispute.

Case Study 7: The Family Promise and Gift Tax

Rahul promises his cousin Neha ₹3 lakhs for starting her CA practice as consideration for her mentoring his staff. The Income Tax Department demands tax, claiming it’s business income, which Neha disputes, arguing it’s a gift.

Question: Discuss the mentoring services as consideration under the Indian Contract Act, 1872, and the payment’s taxability under the Income Tax Act, 1961, resolving the taxation conflict.

Answer: Under Section 2(d) of the Indian Contract Act, 1872, mentoring services are valid consideration if provided at the promisor’s request. Neha’s mentoring forms a valid contract with Rahul, as upheld in Durga Prasad v. Baldeo (1880), where services constituted valid consideration. Under Section 56(2)(x) of the Income Tax Act, 1961, payments from relatives like cousins are exempt as gifts if not for business services, as clarified in CIT v. Parvati Devi (1997), where familial payments were non-taxable if personal. If Neha’s mentoring is professional, the ₹3 lakhs is taxable under Section 28. The Indian Regulatory Framework requires Neha to prove the payment’s nature. If a gift, she must document the familial relationship; if income, report it and pay tax. The CA should advise clear records, ensuring the contract’s validity aligns with tax exemptions, resolving the dispute through compliance.

Case Study 8: The Software Deal’s ITC Dispute

Sanjay pays ₹5 lakhs as advance consideration for software from Tara’s company, claiming ITC. Tara fails to deliver, and GST authorities demand ITC reversal, which Sanjay disputes, citing the contract’s validity.

Question: Evaluate the advance payment as consideration under the Indian Contract Act, 1872, and ITC reversal under the CGST Act, 2017, resolving the taxation conflict.

Answer: Under Section 2(d) of the Indian Contract Act, 1872, Sanjay’s ₹5 lakh advance is valid consideration, forming a contract, as supported by Chinnaya v. Ramayya (1882). Tara’s non-delivery is a breach under Section 73, entitling Sanjay to a refund, as seen in Satyabrata Ghose v. Mugneeram Bangur & Co. (1954). Under Section 16 of the CGST Act, 2017, ITC requires receipt of goods/services; non-delivery mandates reversal under Section 17, as upheld in Carysil Ltd. v. Union of India (2020), where ITC was reversed for non-supplied goods. Tara must issue a credit note under Section 34. The Indian Regulatory Framework requires Sanjay to reverse ITC and pursue damages under civil law. The CA should advise coordinating with Tara for invoice adjustments and filing a refund claim, aligning the contract’s validity with GST compliance to resolve the dispute.

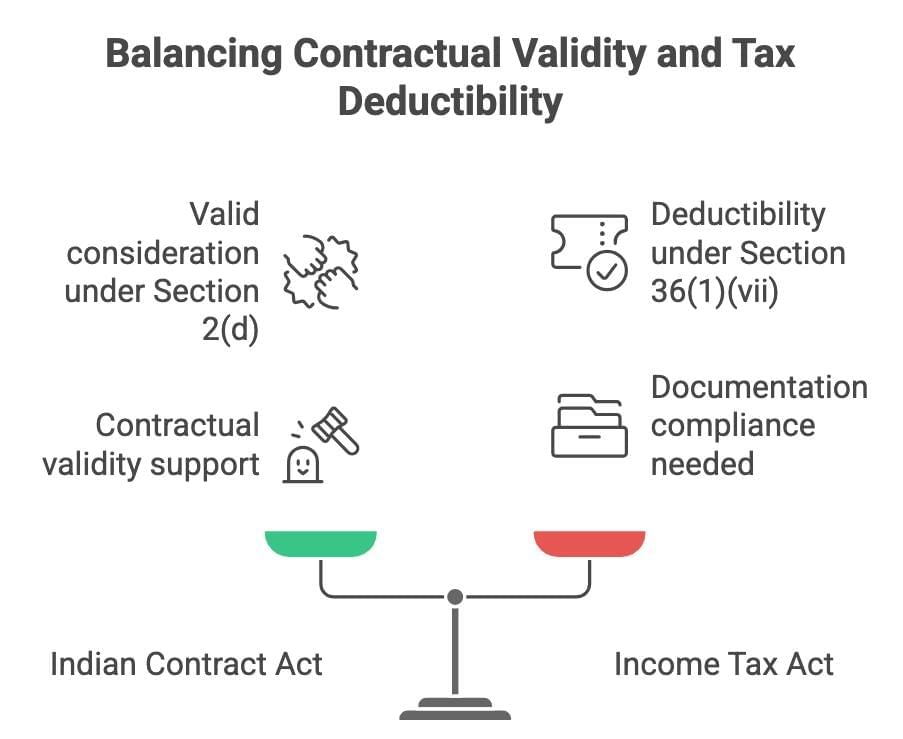

Case Study 9: The Loan Write-Off and Tax Deduction

Aditi’s bank writes off ₹6 lakhs of a client’s loan as consideration for a new financing agreement. The Income Tax Department disallows the deduction, claiming it’s not a business expense, leading to a dispute.

Question: Discuss the loan write-off as consideration under the Indian Contract Act, 1872, and its deductibility under the Income Tax Act, 1961, resolving the taxation conflict.

Answer: Under Section 2(d) of the Indian Contract Act, 1872, forbearance like a loan write-off is valid consideration if at the promisor’s request. Aditi’s bank’s ₹6 lakh write-off forms a valid contract, as upheld in Kedarnath Jute Mfg. Co. Ltd. v. CIT (1971), where forbearance was recognized as consideration. Under Section 36(1)(vii) of the Income Tax Act, 1961, bad debts are deductible if written off per RBI guidelines, as clarified in TRF Ltd. v. CIT (2010), where the Supreme Court allowed deductions for properly documented bad debts. The Income Tax Department’s disallowance may stem from inadequate documentation. The Indian Regulatory Framework, via RBI and tax laws, requires Aditi’s bank to provide evidence of RBI-compliant write-offs. The CA should advise maintaining records and appealing to the Income Tax Appellate Tribunal if compliant, ensuring the contract’s validity and tax deductibility resolve the dispute.

Case Study 10: The Art Sale and GST Evasion

Ravi agrees to sell artwork to Priya for ₹4 lakhs, receiving ₹1 lakh in services as consideration. He fails to issue GST invoices, and the GST authorities issue a notice for tax evasion, alleging fraudulent intent.

Question: Analyze the service-based consideration under the Indian Contract Act, 1872, and GST liability under the CGST Act, 2017, resolving the taxation conflict within the Indian Regulatory Framework.

Answer: Under Section 2(d) of the Indian Contract Act, 1872, services as consideration are valid if lawful. Priya’s ₹1 lakh services form a valid contract with Ravi, as supported by Chinnaya v. Ramayya (1882). Under Section 7 of the CGST Act, 2017, barter transactions are taxable supplies, with GST (28% for artwork) on the market value under Section 15, as upheld in Mohit Minerals Pvt. Ltd. v. Union of India (2020). Ravi’s failure to issue invoices violates Section 31, incurring penalties under Section 122, and may attract fraud charges under Section 415 of the Indian Penal Code, 1860, as seen in State of Gujarat v. Mohanlal Jitamalji Porwal (1987). The Indian Regulatory Framework requires Ravi to pay GST with interest and issue retrospective invoices. The CA should advise compliance with GST returns and cooperation with authorities, ensuring the contract’s validity aligns with tax compliance to resolve the tax evasion dispute.

|

32 videos|235 docs|57 tests

|

FAQs on Case Based Questions: Consideration - Business Laws for CA Foundation

| 1. What is a barter deal and how does it impact taxation in a startup? |  |

| 2. How does TDS apply to freelancers and what are common disputes? |  |

| 3. What are the tax implications of charity donations? |  |

| 4. How does GST affect event planning services? |  |

| 5. What are the key considerations in property deals regarding stamp duty? |  |